At their inception, fraud and identity theft were pretty low-tech. For example, one popular way to steal someone’s information was dumpster diving. Thieves would root through trash to find courtesy checks that individuals had thrown away without care or other pieces of paper that contained sensitive personal information.

Today, fraud and identity theft often occur in ways that are very different than dumpster diving. Although low-tech crime does still happen, high-tech crime is much more prevalent. In short, every time you use your computer, your personal information is at risk from high-tech crime.

Luckily, you can protect your financial data this holiday season with the following tips:

Use a Credit Card

Debit cards link directly to your checking account, which makes you very vulnerable. If your card number gets hacked when you’re shopping online, an unauthorized individual can have instant access to the entire sum of your checking account.

Your bank and the Federal Reserve do offer some protections for illegitimate debit card purchases, but many of them are associated with consumer liability and undue hassle. It’s simply harder to get money back into an account than it is to refute a credit card charge.

Credit cards offer more protection against fraudulent charges than debit cards. With many credit cards, your maximum liability is $50, which is very affordable in the grand scheme of things. With debit cards, people are often liable for around $500.

Overall, try to use a credit card that offers buyer/fraud protection, and stick with a card that has a lower limit to mitigate potential financial harm.

Online Payment Systems

Every time you shop with a company online, they request your financial information. Although giving each business your credit card information is an option, you can also choose to limit the financial data you share with sellers.

The best way to do this is with an online payment system, like PayPal. Before you shop online, set up an account with an online payment company. Then, when you checkout at an online store, pay with your secure online account.

[caption id="attachment_17131" align="aligncenter" width="1024"]

Source eKnowledgeTree[/caption]

Source eKnowledgeTree[/caption]Online payment companies, like Apple Pay, also offer additional protections, like transaction monitoring, online transaction encryption and fraud prevention. If anything seems suspicious, you can contact them directly. Their customer service teams know how to work with customers to resolve charge disputes quickly and effectively.

Unique Passwords

You probably have more online accounts than you realize. Between social media, email and online shopping, it’s easy to rack up accounts quickly.

If you want to protect all of the information stored on these accounts, you need good passwords. Ideally, each of your passwords will be 12-15 characters long, and every one will contain a combination of uppercase letters, lowercase letters, numbers and symbols.

This sounds pretty simple, but volume can complicate things. With many online accounts, creating individual passwords is a huge inconvenience. It’s hard to remember long and complicated passwords for a multitude of sites.

Consumers who want to keep their info safe with unique passwords can benefit from 1Password, an online storage tool. This platform stores all of your passwords and login details, so it’s easy for you to access various online accounts securely.

Beware of Emails and Social Media Messages

As an internet user, you’ve probably been told that clicking links in email messages is a bad idea. Scammers often send links that are malicious to steal information from consumers via email.

What you might be less familiar with, however, is what to do if you receive links via social media sites. Social media messages that come from unknown or suspicious parties should be met with caution. They often use statements or wording that’s meant to pique your interest and entice you to click on the link, but they shouldn’t be trusted.

[caption id="attachment_17129" align="aligncenter" width="671"]

Source Kaspersky Lab[/caption]

Source Kaspersky Lab[/caption]Even if they say something along the lines of “Is this YOU in this photo? I can’t believe you’d do this …” the fact of the matter is that the link will probably not contain a picture or pictures of you. If you click on the link, you won’t see racy photos, but you will put your online safety at risk.

It turns out that a lot of crooks have moved on from email and are now preying on social media users. Don’t fall for their tricks on either platform by avoiding phishing emails and messages.

Keep the Receipt

During the holidays, you might purchase gifts and other products from a variety of vendors. It’s hard to remember the products you purchased and exactly where they came from, which is why holding onto receipts is so important.

Every company should give you a receipt at checkout or via email. As soon as you have this information, make sure you save it in a folder on your computer or print it out for safekeeping. If you do this, you’ll be able to verify the purchases on your bank statement and ensure that no fraudulent charges arise. It’ll also help you in the event you run into warranty issues or have the need to return a product.

Shop Secure

Before you book tickets, buy holiday outfits or purchase gifts online, make sure the site you’re on is secure. At the top of the browser, you should see a small padlock symbol in the address bar. Another way to see if a site is secure is to make sure it starts with “https://.” The “s” in https stands for secure.

In addition to looking for a site’s security, try to determine it’s overall trustworthiness. If an offer or the prices on the site seem too good to be true, they probably are. If the site has many spelling issues and errors, it might not be legitimate.

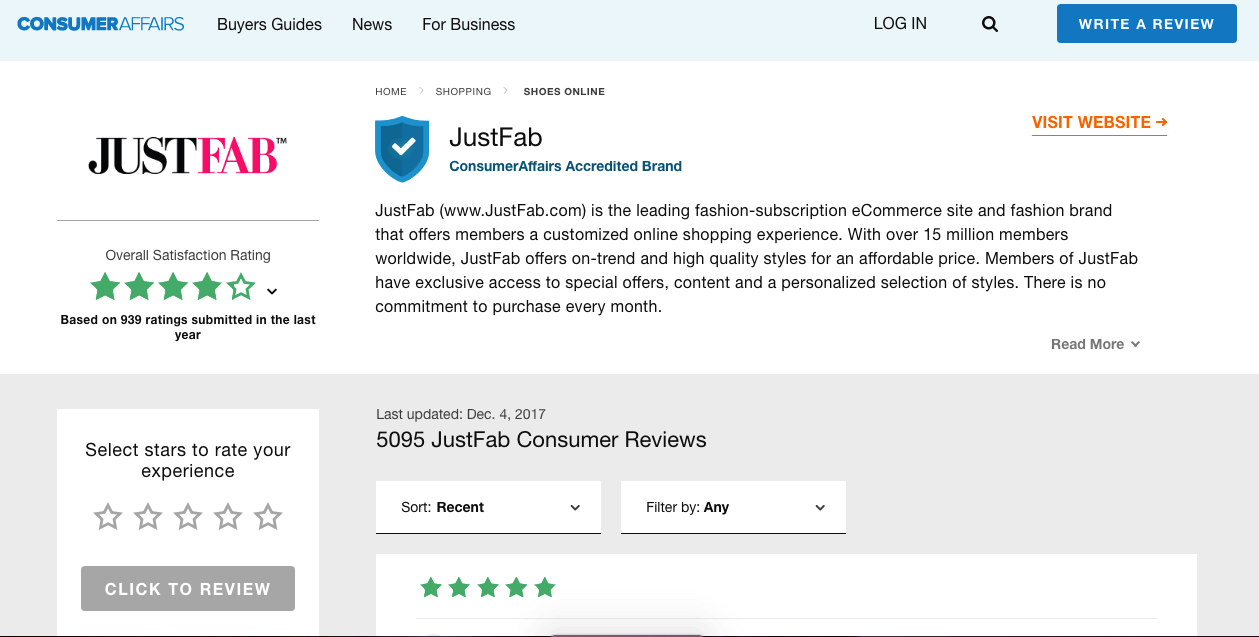

One way to determine if a site is trustworthy is to type “[Business name] scam” into Google. You can also search the company on the Consumer Affairs’ website to look at shoppers’ satisfaction ratings with the company.

[caption id="attachment_17132" align="aligncenter" width="1259"]

Source C onsumer Affairs[/caption]

Source C onsumer Affairs[/caption]Avoid Open Wi-Fi

On-the-go shopping can be convenient, but it’s not always worth it in the long-run. Free open Wi-Fi networks at coffee shops and stores aren’t as safe as you think. Even if you need a password to sign onto them, tons of other people have access to the same password, which puts your data at risk.

Although you can read the news, blogs and even watch shows on open networks, you should avoid activities like banking and shopping while connected. It’s remarkably easy for a criminal to steal your information when you’re both accessing the same network, so don’t give them the chance.

Antivirus and Antimalware

There are numerous ways to protect your computer from threats. Generally, these protections work best in combination, such as antivirus and antimalware systems.

Antivirus software protects your computer from things like viruses, keyloggers and trojans. Viruses infect your computer and have detrimental effects on your system. Keyloggers record the keys you press in order to steal your passwords and other confidential information. Trojans are computer programs that are not what they appear to be. The good news is that the right antivirus software can help protect you from these threats.

Antimalware is designed to prevent, detect and remove malicious programs from your computer. Like antivirus software, it can slow down the speed of your computer. However, its overall benefits far outweigh the decreased computing speed it causes.

Bank Alerts

Many banks offer email or text communication that alerts you when money enters or exits your accounts. Although alerts can differ by bank, you ultimately want to know when big purchases happen and when your login credentials change.

Thieves that gain access to your banking information might try to charge one big purchase to your account. The last thing you want to do is figure this out when you’re reviewing your statement at the end of the month. Tell your bank that you’d like to be notified when large transactions occur on your card. This will allow you to immediately dispute fraudulent charges.

Some criminals will change your login information to lock you out of your bank account. To avoid this from happening, you can request that your bank notify you every time your website or application information changes.

Check Credit History

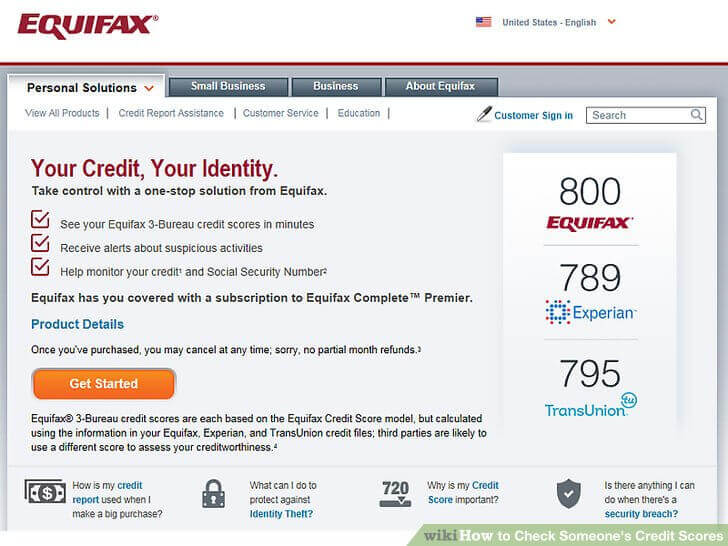

After the holiday season is over, pull your credit report and look for potential fraud. Each year, you can request a report from Experian, Equifax and TransUnion. Review every report and make sure that all of the information is correct. If you see a questionable account or error on your report, you’ll want to dispute the information as soon as possible so it can be removed from your history.

[caption id="attachment_17128" align="aligncenter" width="728"]

Source wikiHow[/caption]

Source wikiHow[/caption]Putting a ‘Bow’ On This

The holidays should be a carefree and joyous time for all. This year, you probably won’t have someone diving through your dumpster to find your personal information, but this doesn’t mean you’re completely safe …

Online criminals are extremely active during the holidays, and they’re always looking for new ways to exploit their victims. To avoid undue stress this season, follow the tips above to protect yourself from online fraud and identity theft.

Featured Image: Unsplash