Are you familiar with an “open door” policy? This idea is standard practice at many businesses, but others denounce it entirely. Those that adhere to the policy believe it increases communication—which is a pillar of a successful organization. However, others believe that it is more of an interruption and inconvenience that can have costly consequences.

Interestingly enough, the internet is very much like an open door policy. It increases communication and productivity—whether you use it to pay bills or work online—but it also increases crime. The web is an open door that allows access in both directions. It’s offers several benefits, but it also makes you very vulnerable.

To use the internet for its benefits and avoid its disadvantages, you need to understand how to protect yourself. At any given time, a criminal can reach into your private life through your computer, but you don’t have to give them the chance. Below, you’ll learn how you can recognize and protect yourself from online scams.

After reading, consider if you are a good candidate for a membership with HelpCloud Tech Support. The membership not only provides the best in identity theft protection and restoration, it also includes 24/7 support and US based experts you can speak with if you have concerns that you’ve been scammed.

Online Scam Overview

An online scam—also known as internet fraud —is when a criminal uses the web to take advantage of another user. These crimes can be difficult to identify, especially because they come in many forms. The main connection between every online fraud is the end goal. The attacker is looking for financial information and/or personal information that they can take advantage of.

Personal information is highly sought after because it can be used maliciously. A fraudster might steal your identity to commit or aid unlawful activity. Someone that steals your financial information is likely looking for money. However, these people may also use or sell the information they gather, which can lead to identity theft.

For example, if a person sends you an email asking for your bank account information, they’ve committed financial fraud. They might turn around create other bank accounts or apply for a loan in your name, which is identify theft.

Risk Groups

Every internet user is at risk for online fraud—but some groups are at more of a risk than others. According to AARP , the main things that dictate someone’s vulnerability to fraud are their online behaviors and their life experiences.

If you click on pop-ups, open email from unknown senders or sign up for free trials, you’re more vulnerable. Hackers and criminals often want you to give them your personal information, like your routing number, or they want you to download a link that will infect your computer with a virus. The three behaviors above are common ways criminals try to carry out these criminal acts.

As far as life experiences go, people that are experiencing a negative event are often more vulnerable to fraud. When you are distraught, your ability to defend yourself online decreases. Individuals that feel isolated, have recently lost a job or are experiencing any negative life change should be especially aware of their online behaviors.

HelpCloud suggests these users follow a simple piece of advice: “If it sounds too good to be true, it probably is.” Don’t click on links or respond to emails that include out-of-this-world offers or deals.

Common Types of Scams

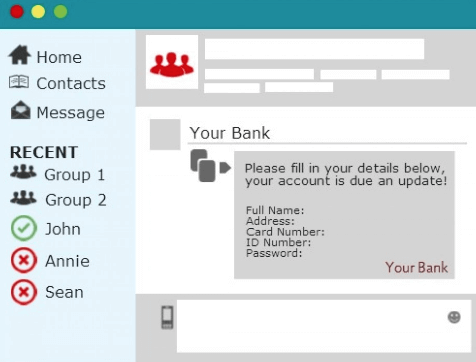

Although fraudsters come up with new schemes every day, they have a few tried-and-true techniques that they often employ. One of the most common is a phishing email. If you receive an email that appears to be from your bank or an online website, you should immediately be suspicious.

These links can make it seem as though you’re just logging into your real account, but you’re often adding your information to a list that’s sent to scammers. Inputting your information on one of these fake sites can give a criminal the information they need to steal your identity or falsely charge things to your bank account.

So, if you ever receive an email that asks for your personal information, wait a moment. The best practice is to call the company that the information is supposedly from and have them confirm the validity of the email. They should tell you right then and there if the communication is legitimate.

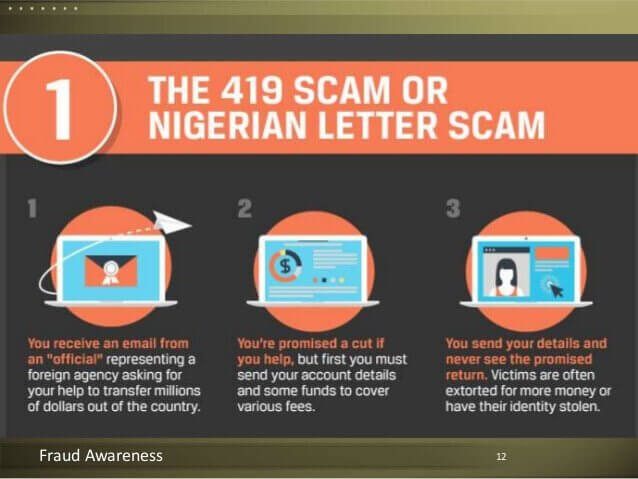

Advanced Fee Fraud, originally known as Nigerian 419 scam, has been around since 1843. It used to be carried out over fax machines and snail mail, but now they’re commonly found on the internet.

Scammers will connect with you online and tell you an elaborate fake story. Generally, they will say that they need help transferring a large amount of money out of their country. They will ask for your bank account details so they can transfer the money to you. However, they won’t send you any money. In fact, they’ll use the information you provide to steal the funds out of your account.

Link scams are also very common. A criminal will send you some type of communication that includes a link. They have many ways to disguise the malicious link. For example, they might send you an email that’s disguised as an online greeting card from a friend or family member. When you click on the link, a harmful software will download onto your computer. The hacker can then gather your personal and financial information for unlawful activities.

Identifying an Online Scam

The first step to protecting yourself against online scams is awareness. Once you know what online scams are, who is at risk and the common types, you’ll be one step closer to protecting your personal information.

As mentioned above, you should also call a company to validate potentially risky communications you receive. When you do, it’s best to pull the number from a source like Google—not the suspect piece of writing.

You can also type in “[Company Name] Scam” into your preferred search engine. The results will give you an up-to-date understanding of what’s happening with the company. They should also tell you if other people are experiencing issues with the same scam.

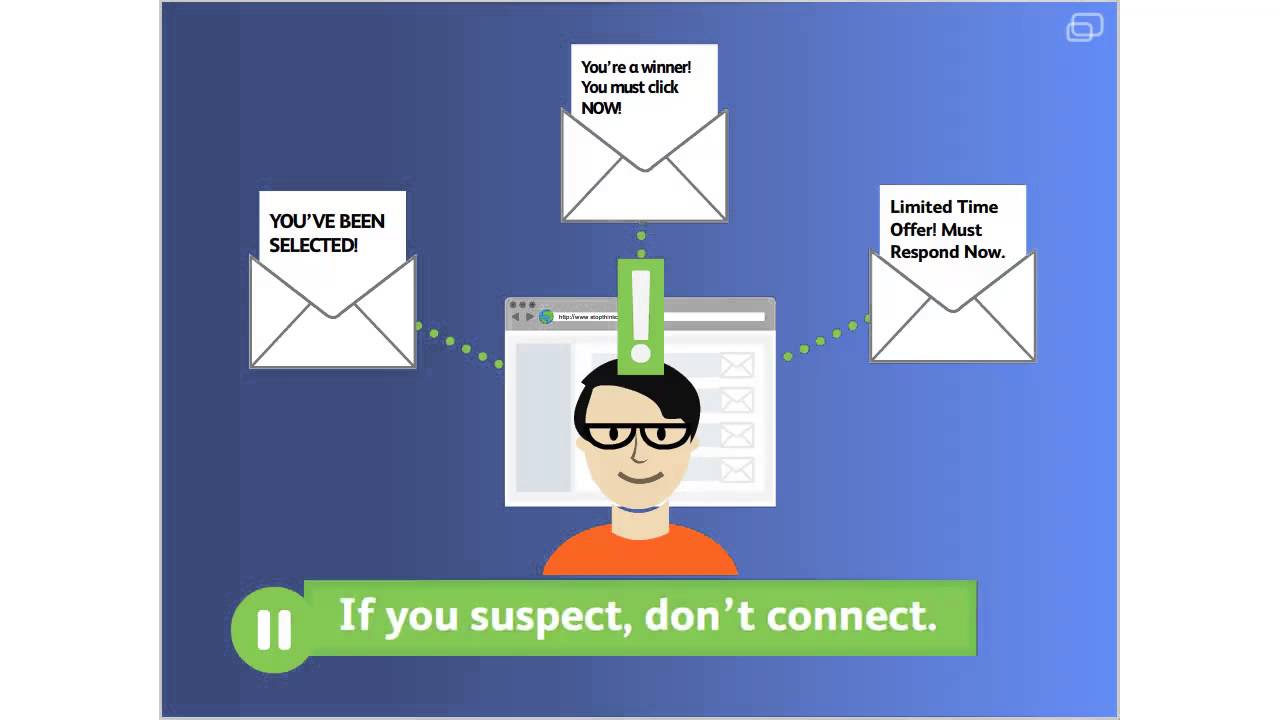

A major red flag is any conversation about money. If you read about a lottery, prize, sweepstakes or your bank account, approach with caution. Unfortunately, it’s not very common to randomly win money online. More often than not, these communications are a scam. Also look out for “phantom riches.” These scams guarantee a certain return if you invest a particular amount.

Look for messages that put pressure onto the reader, too. Phrases like “everyone is doing it” or “almost sold out” are sales pitches that are closely related to scams. Lastly, always read the “terms and conditions” before you accept or sign anything. A lot of scammers neglect to add this component to their content. If they can be found, make sure they’re reasonable. Then, call the company directly to ensure that you understand them correctly.

An Up-and-Coming Scam

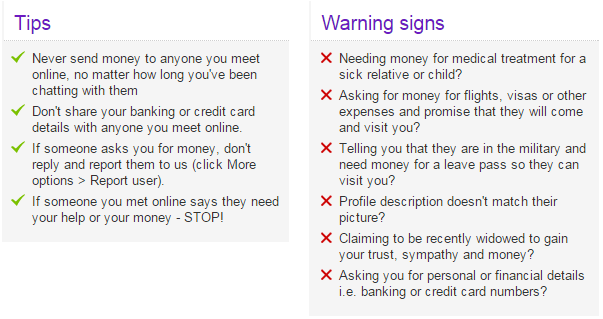

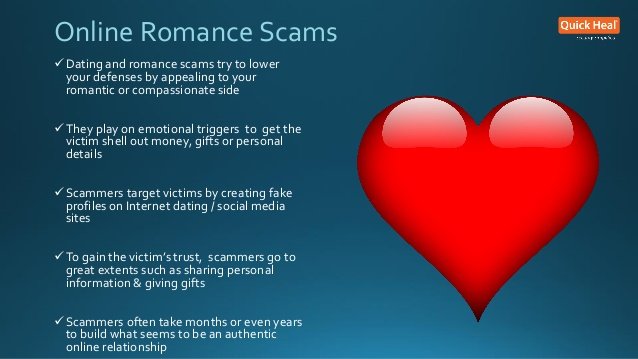

Online scams plague many aspects of the internet—especially online dating. Millions of Americans use online dating websites every year, and so do criminals. These people look for victims and then build a relationship with them. They often target individuals that are divorced, widowed or disabled.

They will contact you and show interest you. They may even send you flowers or gifts as your bond grows. When you have a relationship formed, the scammer will ask for money. These criminals will cater to your interests and needs to take money from you.

Reporting Your Findings

Anytime you run across internet-related crime, you should report your findings to government authorities. In general, there are four parties you can contact. The Internet Crime Complaint Center handles international, federal, state and local internet complaints. The Federal Trade Commission can’t resolve individual complaints, but they can give you information on the next steps to take. They can also help you understand current online scams.

Econsumer.gov specializes in handling complaints about online transactions with foreign companies. Lastly, the Department of Justice can help you if you’ve experienced internet-related intellectual property crime.

All of these agencies are unrelated to your bank. If you notice unauthorized charges or believe your information is at risk, you will need to contact your bank directly so they can help protect you as much as possible.

Another resource that’s open for all consumers is the Better Business Bureau’s (BBB) Scam Tracker. On the tracker’s website, you can tell the BBB about any business or offer you run into that sounds like a scam. After you submit a few pieces of information about the scam, they will investigate it and warn others if it turns out to be fraudulent.

A Critical Component to Online Safety

Open door policies aren’t good or bad, but they do have advantages and disadvantages. Similarly, the internet isn’t always good or bad, but it does have its pros and cons. To experience more of the pros the web has to offer, you need to know how to spot an online scam. If you follow the advice above, you’ll be well on your way to a healthy and positive relationship with the internet.

Always look out for scamming content, and limit the amount of personal information you freely give away. It’s easy to overshare information and post too many photos on social platforms. You want your network to be informed, but you absolutely don’t want to give them too much information. If you do, you’ll put yourself at risk for a range of issues—from online theft to cyberstalking.

For more information about online scams and how you can protect yourself, reach out to HelpCloud Tech Support directly.